Select a Data Category....

Explore Pandemic to Prosperity Data

Browse our data snapshots on topics like housing, jobs, health and more. View our full reports here.

Worker Retention

Since December 2021, 26 million workers have quit their jobs. The job quits rate was highest in leisure and hospitality (5.5% in May) and in retail (4.0% in May) where wages are low and working conditions are poor. With fewer people in the labor market, workers are increasingly demanding higher wages and better working conditions.

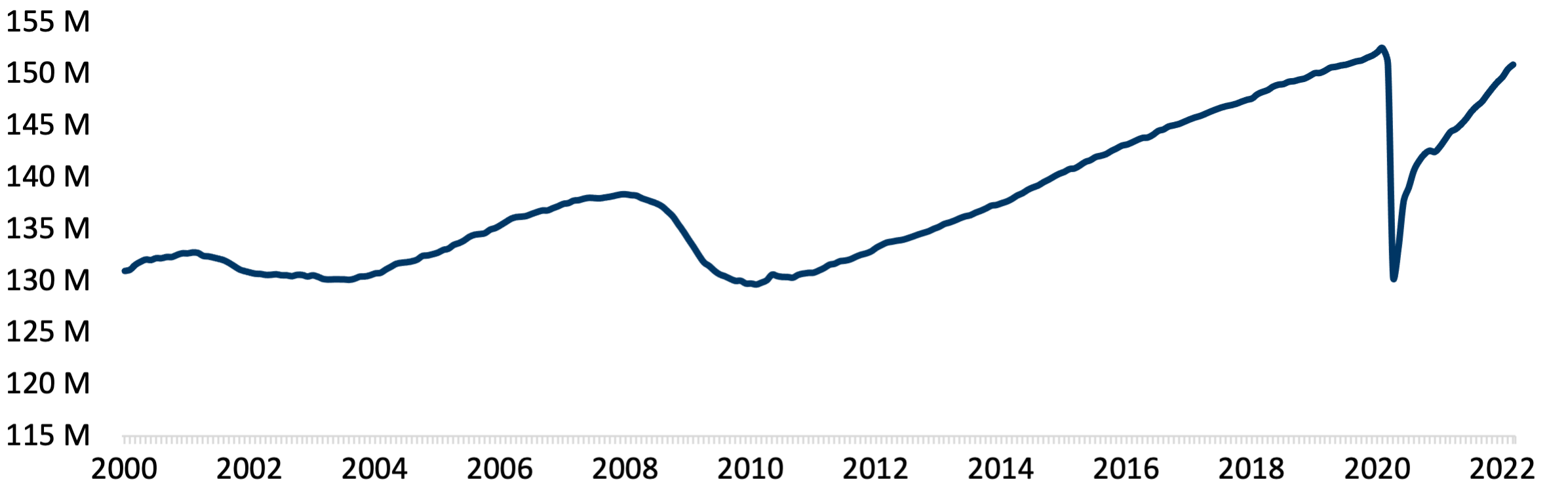

Job Growth

While almost 22 million jobs were lost when Covid hit, they have now, some two years later, been largely recouped. Among Southern states, 6 have more jobs as of May 2022 than they did at their pre-pandemic February 2020 level.

Employment Rates

The employment rate for Black adults aged 16+ increased 2.1 points to 58.6% between December 2021 and June 2022, while overall employment increased 0.4 points to 59.9%. The employment rate for women increased 0.5 points to 56.2% between December 2021 and June 2022.

Medical Debt, by race

During the pandemic, the Families First Coronavirus Response Act boosted enrollments in public health insurance plans such as Medicaid, which contributed to lowering the share of adults with medical debt from 24% in March 2019 to 17% in April 2021. When the health emergency officially ends, many people will lose their public health insurance.

Student Loan Debt

Before the pandemic hit, 1 in 5 families were saddled with student loan debt. The pause on student loan payments saved borrowers an average of $393 a month, an essential support as many struggled with unstable income over the course of the pandemic. Once student loan payments resume, it is estimated that roughly 18 million borrowers will lose $85.5 billion of their income annually.

Worker Retention

Since June 2021, more than 4 million employees have quit their jobs every month. The quits rate has been highest in leisure and hospitality (5.6% in February) and in retail (4.9% in February).

Job Growth

The Covid recession sparked the loss of almost 22 million jobs, which have been largely recouped only two years later. Among Southern states, 5 now have more jobs than they did in February 2020 before the pandemic hit.

Difficulty Paying Expenses

The end of stimulus and child tax credits combined with inflation meant 34% of Americans had difficulty paying household expenses in March 2022, up from 26% in April 2021. Fully 37% of Southerners reported difficulty paying usual household expenses in the last 7 days, compared to only 33% of non-Southerners.

Employment Rates

As jobs increase, the employment rate has inched up to 60.1% but remained below its February 2020 level before the pandemic hit. The employment rate for Black adults was lowest at 58.3%. The employment rate for women inched up to 56.2% in March 2022, while the employment rate for men stayed at 68.1%.

Medical Debt

Before Covid struck, 18% of Americans carried medical debt, with Southerners carrying the highest average medical debt amounts. States that expanded Medicaid by 2014 saw a greater decline in medical debt among their residents than did states that failed to expand Medicaid.

Student Loan Debt

The pause on student loan payments saved borrowers an average of $393 a month, an essential support as many struggled with unstable income over the course of the pandemic. Once student loan payments resume, it is estimated that roughly 18 million borrowers will lose $85.5 billion of their income annually.

Child Tax Credit Benefits

Several studies of the impact of the Child Tax Credit since its inception in 1998 have found that this financial support for children helped increase student test scores, reduce teen birth rates, and yield higher earnings in adulthood.

Employment Rates

The nationwide employment rate of 58.7% is 2 percentage points lower than Feb 2020. Black and Hispanic workers have been hit particularly hard with employment rates down 3 to 4 percentage points. In September 2021, the employment rate for men inched up to 66.7%, while the employment rate for women was stagnant at 54.7%.

Job Growth

The U.S. added 1.7 million jobs in Q1 2022, with 1.6 million jobs still to go to reach the Feb 2020 pre-pandemic peak.

Worker Retention

Since July 2021, more than 4 million employees quit their jobs every month. November reached a new all-time high of 4.5 million quits.

The pandemic caused workers to rethink their options, with some upskilling to transition to higher-paying occupations. Generally speaking, workers are demanding higher wages and better working conditions.

Monthly Poverty Rate by age group

Estimates of monthly poverty rates during the pandemic highlight the benefit of annual Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) payments for children and working-age adults. They also illustrate how stimulus and expanded unemployment payments reduced financial hardships, particularly for children.

Worker Retention

Since January 2021, 30 million workers have quit their jobs. The pandemic caused workers to rethink their options, with some upskilling to transition to higher-paying occupations. Generally speaking, workers are demanding higher wages and better working conditions.

Monthly Poverty Rate by age group

Estimates of monthly poverty rates during the pandemic highlight the benefit of annual Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) payments for children and working-age adults. They also illustrate how stimulus and expanded unemployment payments reduced financial hardships, particularly for children.

Employment Rates

The nationwide employment rate of 58.7% is 2 percentage points lower than Feb 2020. Black and Hispanic workers have been hit particularly hard with employment rates down 3 to 4 percentage points. In September 2021, the employment rate for men inched up to 66.7%, while the employment rate for women was stagnant at 54.7%.

Insufficient Unemployment Benefits

State unemployment benefits in Southern states are insufficient to cover basic household expenses, except in Kentucky. Moreover, 5 Southern states cut off benefits sooner than the national average.